AML/CTF Automation platform

AML/CTF Automation Platform

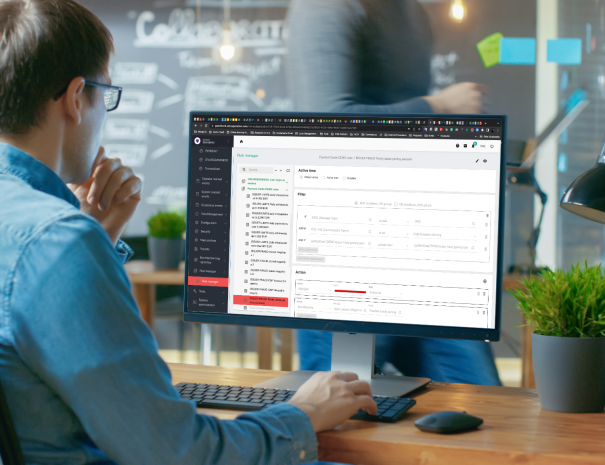

Automate your AML/CTF processes

Compliance with regulatory requirements in today's world cannot be achieved by doing manual or semi-manual screening of customer activity. Automate your customer KYC, onboarding and screening activities and ensure full compliance with monitoring requirements of global regulators (FinCEN, FCA, AMLA) and domestic regulators.

Remote KYC & Onboarding

Customers today demand digital-first services and that includes digital KYC and onboarding as well. Unfortunately, many financial institutions are still stuck with legacy onboarding systems and processes, and are struggling to adapt to the changing market requirements. We help financial institutions upgrade their KYC & onboarding processes by introducing automated system for managing these processes remotely. Our solution can process KYC forms, do automated sanction screening, risk screening & scoring, background checks in paid databases, and other actions that are part of your onboarding process today.

Real-time payments activity monitoring

FinCEN, FCA, AMLA and other regulators around the world require proactive reporting of any suspicious payments activity and issue hefty fines for failing to do so. Having a real-time payments monitoring solution will help you immediately detect any suspicious activity and timely report it to the regulators, avoiding fines and potential tarnishing of your reputation.

Detect money laundering schemes effectively

Analyzing complex network of interrelationships between customers can be cumbersome when using standard tools, especially at large scale. Using our embedded tools, you can detect money laundering patterns in client relationships more effectively. Our network analyzer tool allows you to instantly visualize complex web of connections between customers, detect what exactly connects them and conduct a more in-depth investigation whenever required.

Comprehensive regulatory reports

Our AML/CTF automation solution is integrated with a comprehensive reporting engine, powered by JasperReports. In an easy to use, graphical environment, AML officers can configure all required regulatory reports - BSA filings for FinCEN, FCA standard filings (depending on your institution type) and standard AMLD 6 requirements in the EU. Generated reports are easily exportable in multiple data formats.